- #ARE FUNERAL EXPENSES TAX DEDUCTIBLE IN 2021 FULL#

- #ARE FUNERAL EXPENSES TAX DEDUCTIBLE IN 2021 PLUS#

- #ARE FUNERAL EXPENSES TAX DEDUCTIBLE IN 2021 PROFESSIONAL#

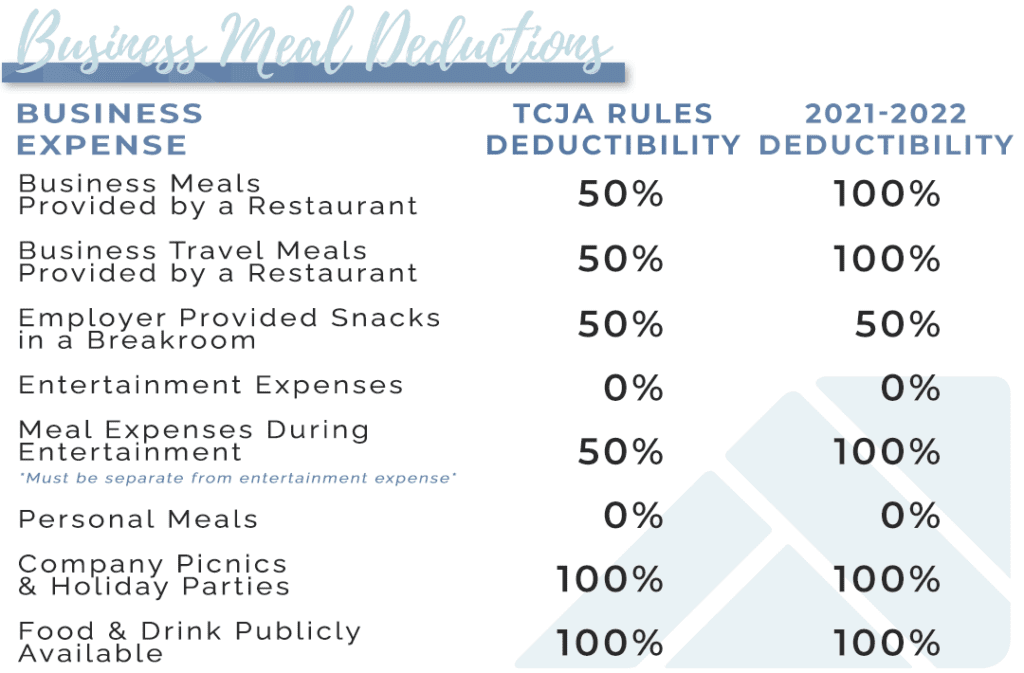

On an estate tax form (Form 706)įorm 706 will need to be filed if the gross estate plus any taxable gifts gifted during the descendant’s lifetime are valued at more than $11.4 million for 2019. The executor is in charge of deducting any expenses on the estate tax form 706 only if the estate qualifies under federal and state laws. This doesn’t include funeral expenses.Įven if you pay for your loved one’s funeral yourself, you cannot deduct these expenses. In reality, the IRS only allows deductions for medical expenses paid to prevent or treat an illness. Many people mistakenly believe that funeral expenses might count under medical expenses.

#ARE FUNERAL EXPENSES TAX DEDUCTIBLE IN 2021 FULL#

Review the full list of non-deductible expenses by reading the IRS’ Miscellaneous Deductions Guide. The 1040 tax form is the individual income tax form, and funeral costs do not qualify as an individual deduction. In short, these expenses are not eligible to be claimed on a 1040 tax form. Funeral and burial expenses are only tax deductible if they’re paid for by the estate of the deceased person. The Internal Revenue Service (IRS) sets strict rules about what expenses can and cannot be deducted from your tax bill. » MORE: Your family has 500 hours of work to do after you die.

#ARE FUNERAL EXPENSES TAX DEDUCTIBLE IN 2021 PROFESSIONAL#

When in doubt, consult with a tax professional or an estate attorney.įirst, let’s look into how these tax deductions take place on the federal level. Tax codes and rules are not always clear, especially if you don’t have professional tax experience. Your specific tax situation depends on several factors. Federal Tax Deductions for a Funeral or Burial A tax professional can help you determine whether your expenses are deductible or not. Whether you hold the funeral in person or virtually, many of the same rules apply. Virtual funeral tip: The cost of a virtual or hybrid funeral, using a service like GatheringUs, may also be tax-deductible, depending on the circumstances. What about funerals? In this guide, we’ll discuss whether you can claim funeral or burial expenses as a tax deduction in 2019. There are deductions for buying a house, medical treatment, school, and so on. Do they qualify for a tax deduction? There are many tax deductions available for all kinds of things each year.

There’s one big question many family members have about funerals. State Tax Deductions for Funeral Expenses.Federal Tax Deductions for a Funeral or Burial.It’s no wonder that people are looking for ways to reduce this cost. This is quite a financial burden for most families. The cost of a funeral is on the rise, and most people pay anywhere from $3,000-$10,000 total. Learn more in our affiliate disclosure.įunerals are expensive. As an Amazon Associate, we earn from qualifying purchases. We also may earn commission from purchases made through affiliate links. We follow a strict editorial process to provide you with the best content possible. The bottom line is that the church must be in total control of the funds and that the person cannot designate that use of the funds for an individual.Cake values integrity and transparency. You can use some or all of the funds for the funeral. The family can give funds to your benevolence or compassion ministry. Another column to read is “ Special Offering for a Woman with Cancer ” from Thursday, September 20, 2018. This allows for anonymity but not a tax deduction.Ĭheck out the “Hey Fletch” column, “Attorney’s Perspective on Designated Funds” from Thursday, November 1, 2018. That can be done but not as a tax deductible gift. Is this type of gift acceptable with the IRS?ĭRF-The way that you have described it, it is pass through giving. Second, the gift could be tax deductible. They would like to do that by giving to the church, for two reasons.

Another family in the church would like to pay for the funeral cost. A family in our church had a very unexpected death in their family. Hey Fletch … I have a question related to a special donation.

0 kommentar(er)

0 kommentar(er)