#2019 california tax table license

Check the state tax rate and the rules to calculate state income tax 5. Welcome to the Campbell County Occupational License Office We are responsible for the collection of the Occupational License Tax within Chapter 110 of the. Determine if the employee's gross annual wages are less than or equal to the amount shown in the Low Income Exemption Table below. Find your pretax deductions, including 401K, flexible account contributions.Withholding Formula >26 < to obtain the gross annual wages.

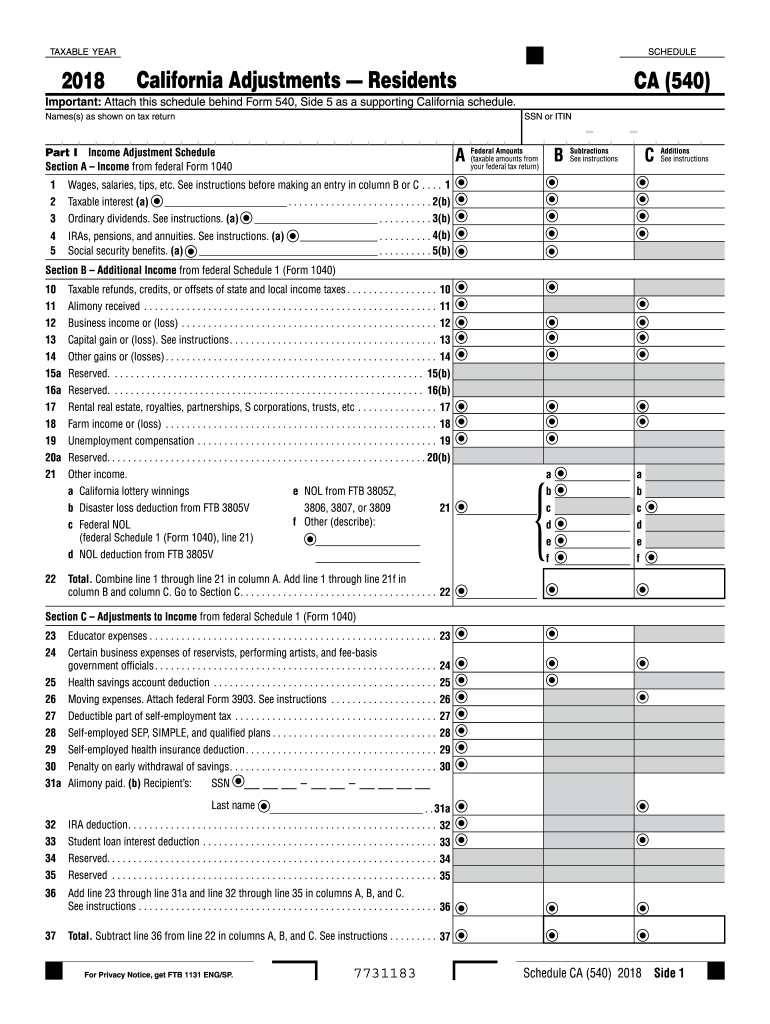

If the employee is using a W-4 in lieu of the California state DE-4, the information for the Additional Exemptions Claimed field should be notated on the W-4. Key differences between poverty thresholds and poverty guidelines are outlined in a table under Frequently Asked Questions (FAQs). If no exemptions are claimed, enter 00.ĭetermine the Additional Exemptions Claimed field as follows:įirst and Second Positions - Enter the number of allowances claimed in Item 2 of the DE-4. Second and Third Positions - Enter the total number of regular allowances claimed in Item 1 of the DE-4. Enter M (married), S (single), or H (head of household). On October 8, 2019, the California Franchise Tax Board (FTB) promulgated amendments to the regulations governing withholding requirements for domestic pass-through entities.1 As a result of the amendments, the FTB released two new forms that apply to domestic pass-through entities when reporting and remitting withholding on distributions of the.

#2019 california tax table free

Contact us today at 81 or fill out our contact form to schedule a free consultation to get started.S, M, H / Number of Regular Allowances / Number of Allowancesĭetermine the Total Number Of Allowances Claimed field as follows:įirst Position - Enter the employee's marital status indicated on the allowance certificate. Our Los Angeles accountants can help guide you in the right direction in every aspect of your tax preparation, in addition to other financial services that you need. The chart below shows how this computation is made. You will also be taxed by a marginal percentage for any amount you made above your highest bracket.

For example, if you are earning $150,000, you will be taxed for the brackets between $ 0.00 and $8,223.00 all the way up to %53,980.00 and $275,738.00. California Single Tax Brackets Tax BracketĬalifornia Married Tax Brackets Tax BracketĬalifornia has a progressive taxation method, which means that you don’t have just one tax bracket, but you every bracket that applies to your income. The following brackets have been in effect since April 2019. In 2017, the “Tax Cuts and Jobs Act” overhauled the tax income through sweeping changes made to the tax code, which many consider the largest changes that have been made in 30 years.

0 kommentar(er)

0 kommentar(er)